How To Become A Repo

Repurchase Understanding (Repo)

The sale and subsequent repossession of the aforementioned security at a future date at a higher cost

What is a Repurchase Agreement (Repo)?

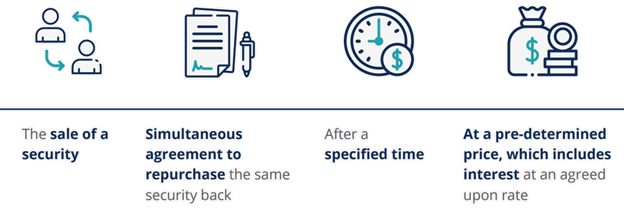

A repurchase agreement ("repo"), also known every bit a auction-and-repurchase agreement, is an understanding involving the auction and subsequent repossession of the same security at a future engagement at a higher price. In elementary terms, it is an exchange of a security (which acts as collateral) for cash. Repurchase agreements are normally used to provide short-term liquidity.

How a Repurchase Agreement Works

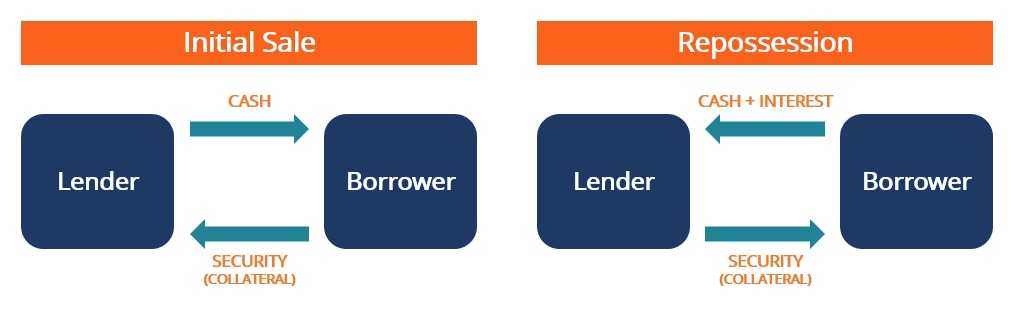

The following is a elementary illustrative example of how a repurchase agreement works:

A repurchase agreement can be thought of as a collateralized loan. The lender provides greenbacks to the borrower in exchange for a security, which acts as collateral. At a future appointment, the borrower repurchases the same security with the initial greenbacks received plus accrued interest.

Summary

- A repurchase agreement involves the sale and subsequent repossession of the aforementioned security at a future date at a higher price.

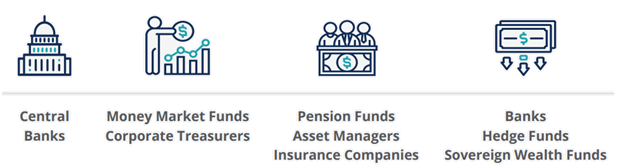

- Participants in a repurchase agreement include central banks, coin market funds, corporate treasurers, alimony funds, asset managers, insurance companies, banks, hedge funds, and sovereign wealth funds.

- Loftier-quality debt securities are used in a repurchase agreement.

Understanding a Repurchase Understanding

Below, the lifecycle of a repurchase agreement and the parties involved are detailed.

The Lifecycle of a Repurchase Agreement

The lifecycle of a repurchase understanding involves a political party selling a security to some other party and simultaneously signing an understanding to repurchase the same security at a future engagement at a specified toll. The repurchase toll is slightly higher than the initial auction price to reverberate the fourth dimension value of coin. This is visually illustrated below.

Participants in a Repurchase Agreement

At that place are ii parties involved in a repurchase agreement:

- The party "selling" in a repurchase understanding: This party is selling the security to the opposing political party and receiving cash. Eventually, this party repurchases the aforementioned security at a future date at a specified toll.

- The party "purchasing" in a repurchase agreement: This party is ownership the security from the opposing political party through lending greenbacks. Somewhen, this political party resells the same security dorsum to the opposing party at a hereafter date at a specified cost.

Participants in a repurchase agreement include central banks, money market place funds, corporate treasurers, pension funds, asset managers, insurance companies, banks, hedge funds, and sovereign wealth funds.

At a loftier level, the political party selling securities in a repurchase agreement normally does so to exist able to heighten short-term funds, while the political party purchasing the securities unremarkably does and so to earn interest on backlog cash.

Still, there may exist specific apply cases for engaging in repurchase agreements. For instance, the U.S. Federal Reserve engages in repurchase agreements as part of its monetary policy and for liquidity management purposes. Specific use cases for repurchase agreements by certain parties are outlined in CFI'southward course on repurchase agreements.

Types of Securities Used in a Repurchase Agreement

In general, high-quality debt securities are used in a repurchase agreement. The securities role every bit collateral in a repurchase agreement. Examples may include government bonds, agency bonds, supranational bonds, corporate bonds, convertible bonds, and emerging marketplace bonds.

The Tenor of a Repurchase Understanding

The duration (time length) of a repurchase agreement is referred to equally the tenor. In that location are 2 principal types of repo tenors:

- Fixed Repo Tenor has a fixed start and end date. Fixed tenors can exist overnight, 1, 2, or 3-months, or even upwards to i or two years.

- Open Repo Tenor does not have a stock-still outset and end date. Repos with an open tenor can exist terminated on whatsoever business day in the future provided that there is sufficient notice by either party.

The Repurchase Understanding Charge per unit

The repurchase agreement charge per unit is the involvement rate charged to the borrower (i.due east., the one that is borrowing cash past using its securities as collateral) in a repurchase agreement. The repo rate is a unproblematic involvement rate that is stated on an annual ground using 360 days. To sympathize this, an example is presented below.

Example

A trader enters into a repurchase agreement with a hedge fund past like-minded to sell U.South. treasuries with a market value of $9,579,551.63 to a hedge fund at a repo charge per unit of 0.09% with a fixed one week tenor. What is the full payment that the trader must make to the hedge fund at the end of the repurchase agreement?

Reply

Offset, nosotros calculate the required involvement payment. This is calculated as Primary ten Repo Charge per unit x (No. of Days Outstanding / 360) = $9,579,551.63 x 0.09% x (7 / 360) = $167.64.

Next, nosotros add the interest payment to the principal amount to determine the total payment. This is calculated as $9,579,551.63 + $167.64 = $9,579.71.27.

To learn more well-nigh the core concepts of brusque-term funding, check out CFI'southward Repo (Repurchase Agreements) form!

Additional Resources

CFI offers the Capital Markets & Securities Analyst (CMSA)® certification program for those looking to take their careers to the side by side level. To keep learning and advance your career, the following resources will be helpful:

- Collateralized Loan Obligations (CLO)

- Federal Reserve (The Fed)

- Quality of Collateral

- Sources of Liquidity

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/repurchase-agreement-repo/

0 Response to "How To Become A Repo"

Post a Comment